Are you an Event Planner, Entertainer, Agent, or other in the Entertainment Field? Well, there is always a slew of headaches awaiting you at tax time. But there is hope.

Get taxed. It’s the American Way

Each year, tens of thousands like you file and hope that all works out ok.

Below are some helpful websites, tips, and advise from people in the know to help you through this nutty time. Just remember that this only applies to United States Tax and always, you should do your own due diligence regarding anything written here to make sure it applies to you…

There are a few things right out of the chute that you will need to do and if you haven’t for this year, strongly consider it for next.

- Keep all original receipts when it comes to a deduction.

- Put names (if applicable) and why it’s a deduction right on the receipt.

- Keep a mileage log. This includes dates, miles driven, and for what reason.

- Entertainment Expenses such as movies, movie rental, and even you satellite or table TV.: See #2

TAX ACCOUNTANTS AND THE DIFFERENCE

We recommend an accountant. But not just any type of accountant. Not H&R Block. That’s for the simple stuff. Even if you are not a major actor like Tom Hanks or singer like Justin Bieber, you have to act like one when it comes to dealing with taxes. You need an “E.A” which stands for “Enrolled Agent”. The difference between and E.A. and a CPA or Tax Preparer is as follows:

TAX PREPARER

According to Wikipedia, a Tax Preparer is as follows:

Until 2011, the U.S. Internal Revenue Service (IRS) did not have a requirement for national registration of paid tax return preparers in the United States. However, effective January 1, 2011, new rules require the registration of almost all paid federal tax return preparers. The new rules require that some paid preparers pass a national tax law exam and undergo continuing education requirements. Persons who are certified public accountants (CPAs), attorneys or enrolled agents are required to register, but are not required to take the exam and are not subject to the continuing education requirements. CPAs and attorneys are licensed on a state-by-state basis, and are subject to state-imposed continuing education requirements to maintain their licenses.

For purposes of the registration requirement, the IRS defines a “tax return preparer” as “an individual who, for compensation, prepares all or substantially all of a federal tax return or claim for refund.”

All tax return preparers, including those tax return preparers who are attorneys, certified public accountants, or enrolled agents, are required to have a practitioner tax identification number (PTIN). This rule is effective for preparation of any federal tax returns after December 31, 2010.

Beginning in mid-2011, tax return preparers (other than CPAs, attorneys, and enrolled agents and a few others) have generally been required to take and pass a competency test to officially become a registered tax return preparer.

Tax return preparers who have PTINs before testing becomes available have until Dec. 31, 2013, to pass the competency test. After testing becomes available, new tax return preparers will be required to pass the competency test before they can obtain a PTIN.

A new continuing education requirement of 15 hours per year has been imposed on tax return preparers (except for CPAs, attorneys, enrolled agents, and a few others).

The IRS has indicated that the new rules apply to all kinds of federal tax returns, including income taxes and payroll taxes.

Our opinion on Tax Preparers is that if you are an Entertainer (or any other person actually), this is not a good option and it could cost you more than you saved in prep fees in the long run.

CPA

A CPA is an accountant who has passed certain examinations and met all other statutory and licensing requirements of a United States state to be certified by that state; “in addition to accounting and auditing, CPAs also prepare tax returns for individuals and corporations”. The equivalent UK professional is a certified accountant.

Additionally, in order to become a CPA, an individual must have a degree (BA or BS). It’s helpful if it is in Accounting, Finance, Administration or Management. A CPA is licensed on a state level and can only practice in that state.

We find this to be a good option for most companies and individuals who have moderate to complex taxation issues, including S and C Corporations, LLCs and General Partnerships.

ENROLLED AGENT

There are two ways to become an EA. One is to have worked for the IRS for a minimum of five years. The other is to pass a three-part exam and to undergo a thorough background check. An EA needs no prior preparer experience in order to take the EA examinations, called the Special Enrollment Examination or SEE. They don’t need to even have filled out a return or ever have to once they become an EA. But they do have to have special competence in tax matters. They are also able to appear in front of the IRS in case you get audited. They are, in our opinion the best option for Entertainers or Entertainment-Related Tax Preparation. The term “Enrolled Agent” is even going to be included in the latest Webster’s Dictionary.

THE ENTERTAINMENT DILEMMA

Entertainment performers may have positions as employees or independent contractors, thus making what is and what isn’t lots of gray.

DEDUCTIONS

There are many deductions one is allowed by the federal tax code when in entertainment. Documentation is key and you must have proof because Entertainers tend to get audited because of the aforementioned.

According to IRS.gov, here is the general guideline on Business Entertainment Expenses:

Entertainment expenses that are both ordinary and necessary in carrying on a trade or business may be deductible if they meet one of the two tests:

- The directly-related test, or

- The associated test

Generally, only 50% of food and beverage (“meal”) and entertainment expenses are allowed as a deduction. For exceptions to the 50% limitation, refer to Publication 463, Travel, Entertainment, Gift and Car Expenses.

Bow before the mighty tax-thingy

MEALS

If you meet someone for a business meeting and have food, you can deduct that as a business expense. Keep the receipt. See #2 at the top.

CHILDREN

Have kids. They’re a good tax deduction.

You may qualify for an Earned Income Tax Credit if you have children.

Families with lower income and three or more qualifying children will continue to be able to claim the Earned Income Tax Credit through 2017.

EDUCATION TAX CREDITS

The American Opportunity Education Tax Credit, which is a $2,500 tax credit for tuition costs for four years of post high school education, can be claimed in 2013 through 2017.

All in all, the best way to protect yourself if audited, is to be able to substantiate all deductions with receipts, notes, photos, playbills, video…anything you can physically bring to an IRS audit.

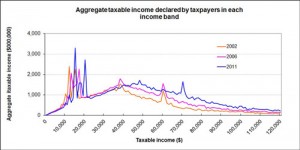

where do you fall on this chart?

7 YEARS OF RECEIPTS

A common rule of thumb is to keep all tax records for 7 years. They can even be electronic, but you should keep them accessible and in a secure environment. Remember, those documents have all of your financial information. Don’t be lax.

*Here are some helpful websites further explaining accountants, deductions and the such.

Find an Enrolled Agent – The Official Website

Special Tax Rules for Entertainers and Tax Returns

Enrolled Agents – A Career Alternative

Save money with these 2013 Tax Rules

Healthy Tax? What?

TAW

Pingback: 手機外殼

thank you for your message. Our blog was created by us through WordPress.

Good luck with your blog!

Pingback: maillot foot